Management Structure

Corporate governance structure and the reasons for adopting such a structure

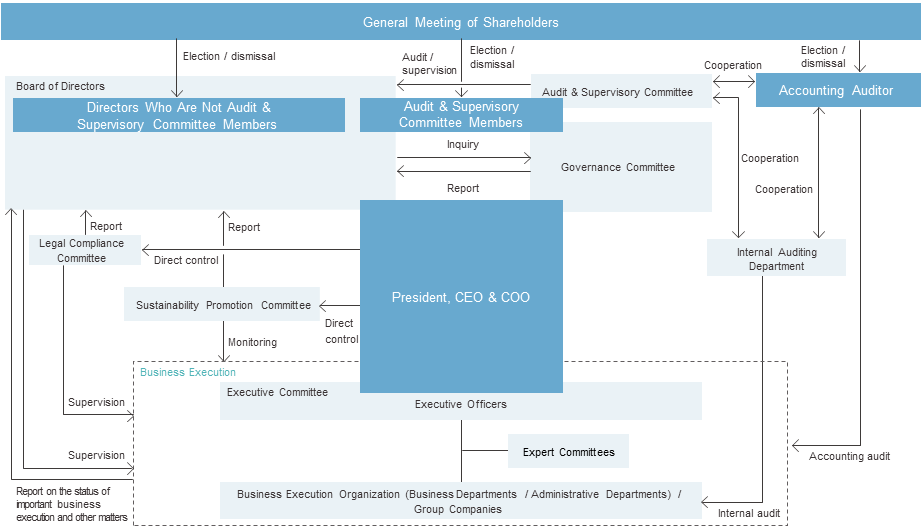

The Company has adopted a governance structure of a company with an Audit & Supervisory Committee. Under this structure, it has established an audit and oversight framework in which directors who are Audit & Supervisory Committee members, including three outside directors, conduct audits and provide oversight. The directors who are Audit & Supervisory Committee members exercise voting rights at meetings of the Board of Directors to further strengthen the supervisory function of the Board of Directors and the transparency of management.

Each director (including directors who are Audit & Supervisory Committee members) performs his or her duties as a member of the Board of Directors in a free and independent manner with respect to decision-making and the execution of duties. In addition, the Company has established a system to ensure sufficient and active discussion at meetings of the Board of Directors. Moreover, three outside directors who are Audit & Supervisory Committee members, along with one outside director who is not an Audit & Supervisory Committee member, conduct objective and rational audits and provide oversight to ensure the legality and appropriateness of business execution from an external perspective. The Company believes this structure fully fulfills its management oversight function.

| Name | Description | Number of meetings held in FY03/2025 | |

|---|---|---|---|

| 1 | Board of Directors | The Board of Directors consists of all directors and has been positioned as the committee responsible for making strategic decisions and overseeing the Company’s operations. The Board of Directors meets at least once a month, in principle, to make decisions on important management matters and to supervise the directors’ execution of duties. | 16 |

| 2 | Executive Committee | The Executive Committee consists of executive officers and those who were approved by the Board of Directors and was established as an organization for conducting discussions and exchanging important information and opinions on matters related to business execution. | 26 |

| 3 | Audit & Supervisory Committee | Directors who are Audit & Supervisory Committee members attend important meetings such as Board of Directors’ meetings and conduct interviews with the heads of sales and administrative divisions to audit and supervise the appropriateness of decision-making by management on important matters (including the decision-making process), as well as the execution of duties by directors (excluding those who are Audit & Supervisory Committee members) and executive officers. The Audit & Supervisory Committee meets regularly once a month to share information with outside directors regarding the status of management, audit results, and other matters, and to exchange opinions. | 15 |

| 4 | Governance Committee | The Governance Committee aims to enhance the Company’s corporate governance structure in order to strengthen the independence and objectivity of the functions and accountability of the Board of Directors regarding director nomination, remuneration, etc., and to protect the interests of minority shareholders. The Committee consists of three members: President, CEO & COO Tatsuyuki Sakoda, Outside Director Masaaki Sawano, and Outside Director Hiromasa Suzuki. It is Chaired by Outside Director Masaaki Sawano. | 5 |

| 5 | Legal Compliance Committee | The Legal Compliance Committee is chaired by the president and having directors (excluding directors who are Audit & Supervisory Committee members), executive officers, and other members. The committee deliberates on important compliancerelated issues and reports the results to the Board of Directors and the Executive Committee as necessary. | 6 |

| 6 | Sustainability Promotion Committee | The Sustainability Promotion Committee is chaired by the President and composed of directors and executive officers. The Committee monitors the progress of sustainability-related initiatives to enhance corporate value on a sustainable basis, and reports the results to the Board of Directors and the Executive Committee as necessary. | 5 |

| 7 | Business Investment Committee | Chaired by the president, CEO & COO, the Business Investment Committee discusses and deliberates the appropriateness of risk–return assessments and plans and the feasibility of important investments and financing. | 3 |

| 8 | M&A Promotion Committee | The M&A Promotion Committee is chaired by the general manager of the Corporate Planning Division and consists of the general manager of the Sales Department and other members. The committee deliberates on and examines matters pertaining to the business portfolio of Group companies, including M&A and the Group’s medium- to long-term management plan, from the perspective of improving consolidated management. | 3 |

Committee Members

| Name | Position | Committees and Committee Members | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Board of Directors | Executive Committee | Audit & Supervisory Committee | Governance Committee | Legal Compliance Committee | Sustaina bility Promotion Committee |

Business Investment Committee | M&A Promotion Committee | ||

| Tatsuyuki Sakoda | President, CEO & COO, President and Executive Officer |

- | |||||||

| Hiroshi Yoshida | Director, Managing Executive Officer |

- | - | ||||||

| Kazuhiro Tohge | Director, Executive Officer | - | - | - | - | - | - | ||

| Nobuyuki Inohara | Director | - | - | - | - | - | - | - | |

| Chizu Sekine |

Outside Director | - | - | - | - | - | |||

| Shigemasa Yabu | Director, Full-Time Audit & Supervisory Committee Member |

- | - | - | |||||

| Masaaki Sawano | Outside Director, Audit & Supervisory Committee Member |

- | - | - | |||||

| Hiromasa Suzuki | Outside Director, Audit & Supervisory Committee Member |

- | - | - | |||||

| Hiroko Noda |

Outside Director, Audit & Supervisory Committee Member |

- | - | - | - | ||||

Diversity of the Board of Directors

| Name | Gender | Length of Service*1 | Area of Expertise and Experience | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Management | Global | Finance and Accounting | Risk Management | Sales and Marketing | Sustainability and ESG | |||

| Tatsuyuki Sakoda | male | 3 years | ||||||

| Hiroshi Yoshida | male | 1 year | ||||||

| Kazuhiro Tohge | male | 7 years | ||||||

| Nobuyuki Inohara | male | 1 year | ||||||

| Chizu Sekine |

female | Newly appointed | ||||||

- *1Indicates number of full years of service as of June 20, 2025.

| Name | Gender | Length of Service*1 | Area of Expertise and Experience | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Management | Global | Finance and Accounting | Risk Management | Sales and Marketing | Sustainability and ESG | |||

| Shigemasa Yabu*2 | male | 3 years | ||||||

| Masaaki Sawano | male | 7 years | ||||||

| Hiromasa Suzuki*3 | male | 3 years | ||||||

| Hiroko Noda*4 | female | 1 year | ||||||

- *1Indicates number of full years of service as of June 20, 2025.

- *2Shigemasa Yabu served as a director of the Company for six years prior to concurrently serving as an Audit & Supervisory Committee member.

- *3Hiromasa Suzuki served as a director of the Company for one year prior to concurrently serving as an Audit & Supervisory Committee member.

- *4Hiroko Noda served as a director of the Company for two years prior to concurrently serving as an Audit & Supervisory Committee member.

Definition of each skill

- Corporate Management

- Has experience as a corporate manager and has considerable knowledge of organization management of a whole group as well as management strategies.

- Global

- Has experience working overseas and of management in an overseas company, and has considerable knowledge of global corporate management.

- Finance and Accounting

- Is a certified public accountant or a certified public tax accountant, or has experience engaging in finance and accounting in finance and accounting departments, etc. at a corporation, and has considerable knowledge of these fields.

- Risk Management

- Has business experience in the fields of risk management, corporate legal affairs and compliance, and has considerable knowledge in supervising corporate management.

- Sales and Marketing

- Has business experience in a sales department, and has considerable knowledge of sales and marketing in a wide range of business domains.

- Sustainability and ESG

- Has experience in corporate management aiming for sustainable growth, and has considerable knowledge of sustainability and ESG.

CEO Succession Plan

CEO Succession Plan

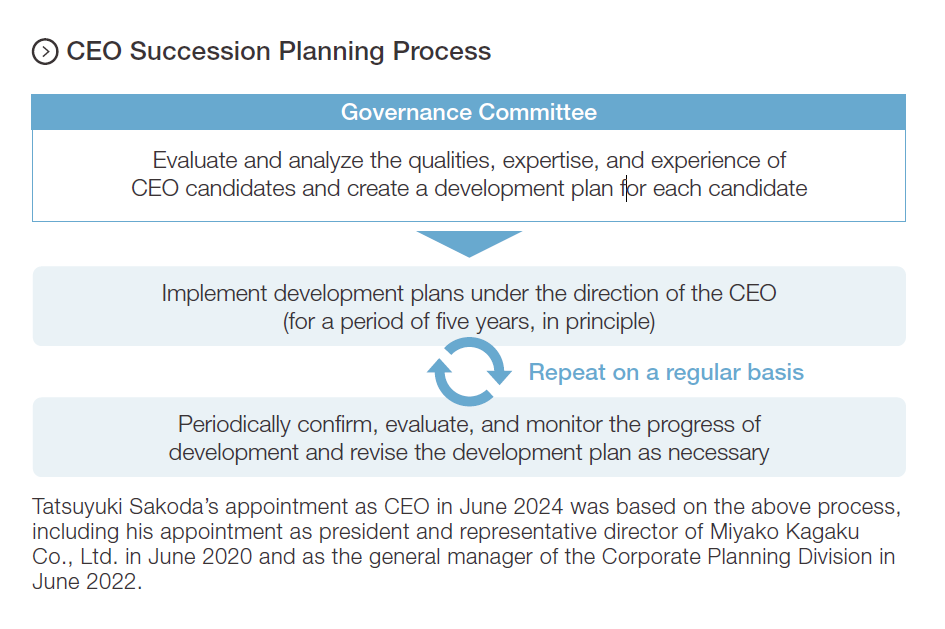

To enhance corporate value over the medium to long term, Chori has positioned the formulation and implementation of a CEO succession plan as one of its key management issues and has established and is working to develop the CEO Succession Planning Guidelines.

- 1The CEO is best qualified to lead the Group’s transformation and growth and the enhancement of corporate value to realize Chori’s corporate philosophy and management strategy. Therefore, based on the view that the appointment of the CEO is the most important strategic decision of the Company, we have positioned the formulation and implementation of a CEO succession plan as a key theme of our management strategy.

- 2The qualities required of a CEO are discussed by the Board of Directors and the Governance Committee, the majority of which is composed of outside directors. The requirements of the CEO position are reviewed as appropriate in accordance with changes in society and the business environment.

- 3Candidates for the position of CEO who meet the required qualifications shall be selected from not only within the Company but also from outside the Company. In any case, the Governance Committee shall deliberate on the selection process and ensure its transparency and objectivity in cooperation with the parent company.

- 4The selected candidates shall be given the opportunity to systematically acquire and develop the qualities, expertise, and experience required of a CEO under the direction of the current CEO, and the Governance Committee shall periodically confirm and monitor the status of this progress.

- 5The Governance Committee shall report to the Board of Directors in a timely manner on the replacement of the CEO in the case of an emergency or in the event that the current CEO is unable to return to their position.

-

Candidates to succeed the CEO are selected from among directors, executive officers, and other members through deliberations by the Governance Committee. If necessary, the committee will deliberate on the appointment of candidates from outside the Company. Based on our corporate philosophy, management policy, and specific management strategies, the Governance Committee shall engage in sufficient discussions with CEO candidates and deliberate objectively and transparently based on the qualities required of a CEO (determination, integrity, conceptualization skills, decision-making ability, and communication skills) as stipulated in the CEO Succession Planning Guidelines.

Selection of CEO Candidates

Maintenance of a Certain Level of Independence from Our Parent Company

Toray Industries, Inc., our parent company, holds 12,967,000 of the Company’s common shares (52.41% of voting rights).The Company constantly works to strengthen the combination of our ability to sell and collect information on fibers and chemicals, which represent our core business, in Japan and overseas, and the parent company’s ability to develop materials in order to generate synergies and enhance corporate value for both companies. In addition, by operating under a parent company, the Company is able to gain a better understanding of market trends and the business environment, enhance its credibility, and enjoy other benefits that come with being a Group company.

With the exception of one director who does not execute business, the executives and employees at the Company do not concurrently serve as executives or employees at the parent company or Group companies and the Company does not accept employees through transfers from the parent company or Group companies. In addition, the Company has its own management plan in place, through the execution of which we have developed our business.

To promote sustainable growth and enhance corporate value, Chori and Toray Industries, Inc., have formed an agreement to implement the following:

- 1Verify the appropriateness of the Company maintaining its listed status

- 2Execute appropriate transactions between the Company and Toray Industries, Inc.

- 3Ensure the effectiveness of corporate governance that considers the interests of the Company’s general shareholders

- 4Execute proper risk management for the Toray Group (including prior consultations on specific matters regarding corporate governance and internal controls)

Based on strict adherence to the abovementioned agreement, we have determined that the Company’s operational independence from its parent company is sufficiently maintained.