Executive Remuneration

Policy on decisions related to executive remuneration

1. Basic Policies

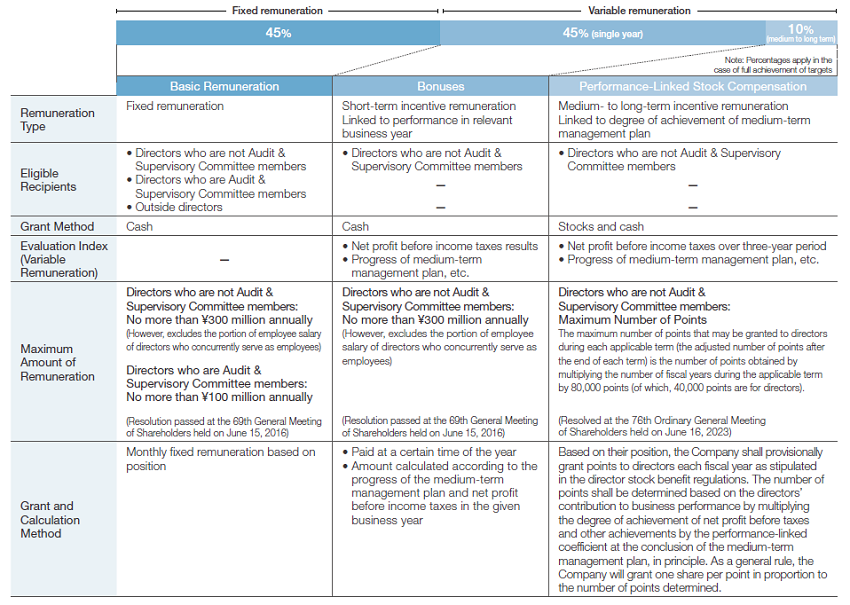

A remuneration structure in which the remuneration of Chori’s directors (excluding directors who are Audit & Supervisory Committee members; the same shall apply hereafter) is linked to shareholder interests shall be in place in order to fully function as an incentive to continuously improve corporate value. Our basic policy in determining the remuneration of each director is to set it at an appropriate level based on their position, performance, and other factors. Specifically, director remuneration consists of three types: monthly base remuneration, a yearly bonus, and performance-linked stock remuneration based on a stock remuneration scheme called Board Benefit Trust-Restricted Stock (BBT-RS).

2. Overview of Executive Remuneration System

3. Policy for procedures for deciding the specifics of compensation on an individual basis

Among compensation for Directors (excluding Directors on the Audit & Supervisory Committee Members), decisions on basic compensation are made on an individual basis by resolution of the Board of Directors, based on deliberations at the Governance Committee.

Among compensation for Directors (excluding Directors on the Audit & Supervisory Committee Members), specific details of bonus decisions in individual cases are entrusted to the President, CEO & COO. When deciding amounts of compensation in individual cases, the President, CEO & COO as entrusted by the Board of Directors shall make a decision based on the content of a report received from the Governance Committee, which deliberates the draft version; such decision being conditional on compliance with a resolution of the General Meeting of Shareholders and geared to ensuring the appropriateness of the compensation level and the transparency of the performance evaluation. For compensation of Directors (excluding Directors on the Audit & Supervisory Committee Members), decisions on Board Benefit Trust-Restricted Stock (BBT-RS) are made on the Share Benefit Regulations for Directors and Officers. The Share Benefit Regulations for Directors and Officers shall be revised or abolished by a resolution of the Board of Directors based on deliberation of the Governance Committee.

Director Remuneration in FY03/2025

| Classification | Total Amount of Remuneration (Millions of Yen) |

Total Amount of Remuneration by Type (Millions of Yen) | No. of eligible Directors |

||

|---|---|---|---|---|---|

| Fixed compensation (monetary) |

Bonus (monetary)*3 |

Board Benefit Trust-Restricted Stock (non-monetary)*3 *4 |

|||

| Directors (excluding Audit & Supervisory Committee Members)*1 *2 (Of which, Outside Directors) |

205 (1) |

88 (1) |

87 (-) |

29 (-) |

5 (1) |

| Directors (Audit & Supervisory Committee Members) (Outside Directors) |

44 (25) |

44 (25) |

- (-) |

- (-) |

4 (3) |

| Total (Of which, Outside Directors) |

250 (27) |

133 (27) |

87 (-) |

29 (-) |

9 (4) |

- *1. Not including the portion of employee’s salary for Directors who concurrently serve as employees.

- *2. The number of eligible Directors above does not include two Directors (excluding Directors on the Audit & Supervisory Committee Members) serving without compensation.

- *3.Of the above items, bonuses are stated as payment amounts corresponding to ¥16,300 million for net profit before income taxes for FY03/2025, and Board Benefit Trust-Restricted Stock are stated as payment amounts corresponding to the cumulative net profit before income taxes target of the medium-term management plan.

- *4.Of the above items, the amounts stated as Board Benefit Trust-Restricted Stock is the amount recorded as an expense for the current fiscal year.