Business and Other Risks

The material risks that management believes could significantly affect the financial condition, business results, and cash flows of CHORI CO., LTD. and its Group companies (“the Group”) are outlined below. These risks are included in the information presented in the Annual Securities Report, including the business overview and financial overview. To address these risks, the Group promotes risk management in accordance with its Risk Management Rules.

Unless stated otherwise, the forward-looking statements herein were determined by the Group as of the end of the fiscal year ended March 2025 under review.

Risk management system and activities

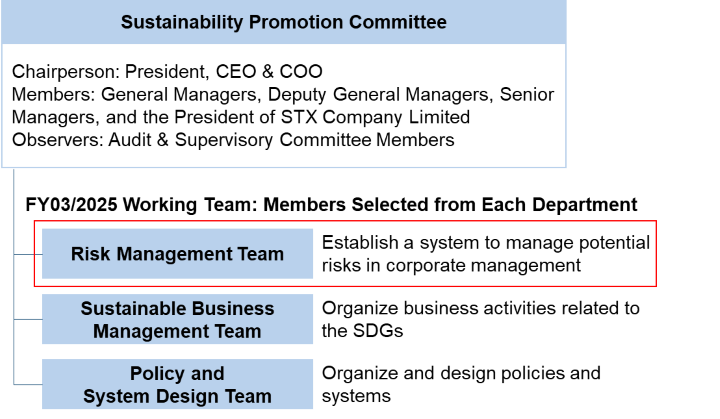

Under the Sustainability Promotion Committee established in April 2024, we have established the Risk Management Team composed of members selected from across the Company. The team has identified risks and formulated response measures.

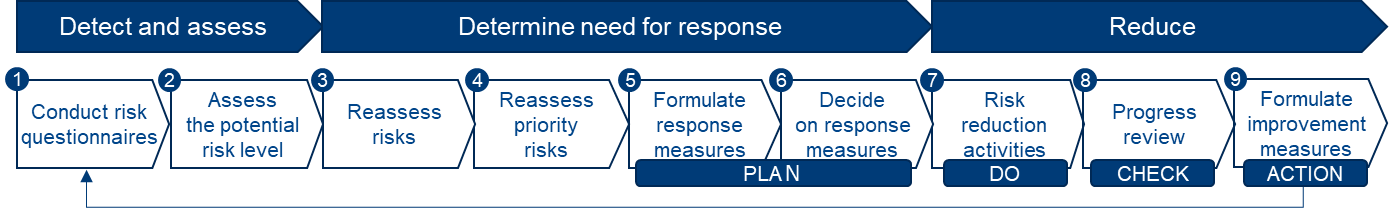

- 1Risk detection and assessment

We ensured that a comprehensive range of risks were covered and then classified the risks into approximately 30 categories. We conducted a questionnaire survey on specific details and assessments of each risk. The information obtained from the questionnaire survey was then aggregated and analyzed.

- 2Current awareness and identification of response measures

Based on the questionnaires, we visualized the risks (risk mapping). For each risk, we examined the current response status and considered necessary response measures.

- 3Deliberation and determination

The Group’s risk visualization (risk map) and risk management process (PDCA cycle) were discussed and confirmed by the Sustainability Promotion Committee and subsequently reported to and approved by the Board of Directors.

From fiscal 2025 onward, the Group will undertake initiatives to reduce risk based on the process described above.

Risk factors

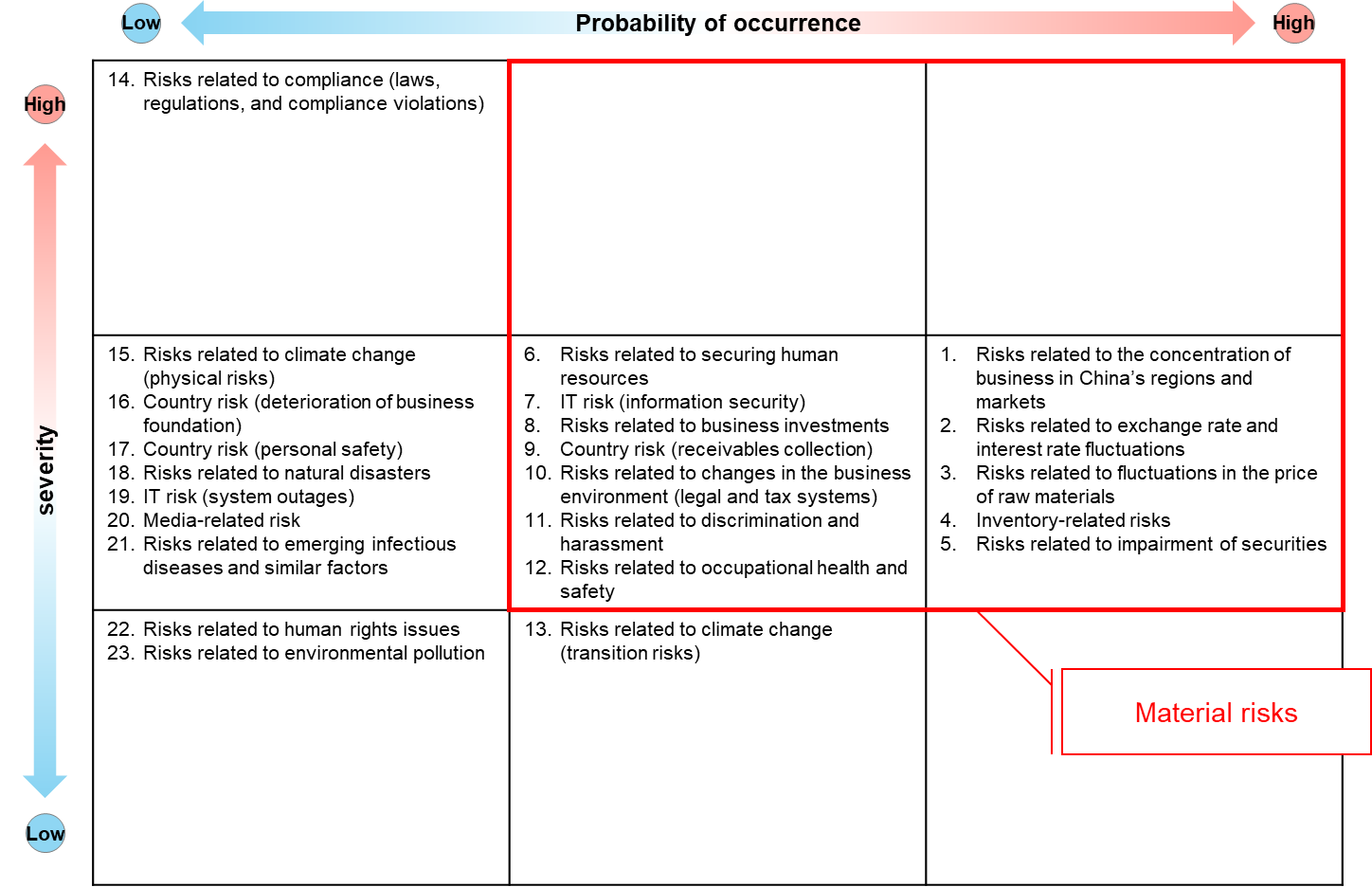

Regarding the risks classified into approximately 30 categories, we evaluated and reclassified them based on the questionnaire results. We then placed 23 risk factors on a risk map using probability of occurrence and severity as key factors. Of these, risk factors judged to have a high probability of occurrence and severity (the 12 factors in the red box) were designated as material risks.

Risk factors and descriptions of risk

| Risk factor | Description of risk |

|---|---|

| 1. Risks related to the concentration of business in China’s regions and markets | Threat of new entrants, bargaining power of buyers and sellers, threat of substitutes, and changes in the competitive environment among industry peers |

| 2. Risks related to exchange rate and interest rate fluctuations | Unanticipated fluctuations in foreign exchange rates and interest rates |

| 3. Risks related to fluctuations in the price of raw materials | Fluctuations in commodity prices and supply chain diversification |

| 4. Inventory-related risks | Prolonged inventory turnover period due to factors such as declining sales prices |

| 5. Risks related to impairment of securities | Decline in the share prices of securities held in the stock market |

| 6. Risks related to securing human resources | Shortage of human resources required to execute the Company’s strategies and business plans |

| 7. IT risk (information security) | Breaches of information and data security due to factors such as cyberattacks, and the occurrence of information and data security incidents in business activities |

| 8. Risks related to business investments | Excessive risk-taking and the occurrence of events arising from business management and commercial transactions (such as defaults, complaints, and litigation) |

| 9. Country risk (receivables collection) | Suspension of foreign currency remittances and exchanges by banks, etc., due to factors such as the deterioration of fiscal conditions in specific countries |

| 10. Risks related to changes in the business environment (legal and tax systems) | Infringement of the Company’s rights in its businesses due to policy shifts or changes of government in specific countries |

| 11. Risks related to discrimination and harassment | Incidents of discrimination and harassment |

| 12. Risks related to occupational health and safety | Incidents of long working hours, forced labor, etc., and occupational accidents (physical injuries and mental health issues) |

| 13. Risks related to climate change (transition risks) | Changes in policies, laws and regulations, technologies, markets, and reputation associated with the transition to a decarbonized society |

| 14. Risks related to compliance (laws, regulations, and compliance violations) | Incidents of violations of antitrust law (cartels and bid-rigging), bribery violations, export control and sanctions violations, and compliance breaches by officers and employees (including accounting fraud, embezzlement, theft, and other criminal acts or misconduct) |

| 15. Risks related to climate change (physical risks) | Increasing frequency and severity of hazards caused by climate change (flooding, inundation, wildfires, cyclones, droughts, etc.) |

| 16. Country risk (deterioration of business foundation) | Incidents of war, civil unrest, terrorism, and similar events that significantly impair business foundations in the countries where business investees or partners are located |

| 17. Country risk (personal safety) | Incidents of war, civil unrest, terrorism, and similar events that cause harm to individuals and other adverse effects in the countries where business investees or partners are located |

| 18. Risks related to natural disasters | Occurrence of earthquakes and other natural disasters at head offices, domestic and overseas business sites, countries and regions where business investees operate, regions where we conduct operations such as raw materials procurement and product sales |

| 19. IT risk (system outages) | Occurrence of IT system outages caused by server and network failures and similar events |

| 20. Media-related risk | Dissemination of negative, underestimated, or erroneous information about the Group to stakeholders (through news reports, mass media, social media, institutional investor presentations, etc.) |

| 21. Risks related to emerging infectious diseases and similar factors | Outbreak and spread of emerging infectious diseases at head offices, domestic and overseas business sites, and in countries and regions where business investees are located |

| 22. Risks related to human rights issues | Occurrences of human rights violations in trading and investment/financing businesses (child labor, forced labor, poor working conditions, etc.) |

| 23. Risks related to environmental pollution | Occurrence of water, air, soil, or groundwater pollution resulting from business activities such as operations and the purchase of land and buildings |

Material risks

| 1. Risks related to the concentration of business in China’s regions and markets | |

|---|---|

| Description of risk | The Group positions China as a key business region, both as a consumer market and a manufacturing base, and has invested management resources accordingly (net sales in fiscal 2024: ¥48.3 billion). For this reason, if the business environment in China were to deteriorate due to factors such as fluctuations in the renminbi, changes in the financial system, or tax or legal systems, deterioration in Japan-China relations, or trends in U.S.-China trade friction, the Group’s business results and financial condition could be adversely affected. |

| Risk response measures | The Group has established the position of Executive Chief Representative for China of the Company to oversee operations in China’s regions. In collaboration with external experts who have in-depth knowledge of China’s legal and tax systems, among other aspects of the country, the Group has established a system that enables it to promptly grasp political and economic conditions and legal and regulatory developments. Based on consolidated management centered on our business, the Group also works to improve the business environment and unify business operations, while sharing information on China’s regions in a timely manner and taking steps to avoid risk as necessary. In addition, the Group is working to diversify risk by building a global alternative supply chain. |

| 2. Risks related to exchange rate and interest rate fluctuations | |

|---|---|

| Description of risk | The Group conducts business activities globally and engages in transactions in various currencies. For this reason, unexpected fluctuations in exchange rates may affect the procurement costs of the products it handles, product manufacturing costs, and selling expenses such as packing and transportation costs. These changes could adversely affect the Group’s business results and financial condition. Furthermore, if interest rates rise due to changes in monetary policy in Japan and overseas, leading to an increased interest burden or financing difficulties, this could also adversely affect the Group’s business results and financial condition. |

| Risk response measures | The Group mitigates the impact of foreign exchange rate fluctuations by entering into forward exchange contracts, while closely monitoring market developments such as foreign exchange rate fluctuations. With regard to interest rates, while regularly monitoring interest rate trends, the Group utilizes its cash management system to efficiently manage and allocate funds across the Group. |

| 3. Risks related to fluctuations in the price of raw materials | |

|---|---|

| Description of risk | The Group handles products such as fiber raw materials, textiles and industrial textile materials, apparel products, chemicals, and transportation equipment. Each product forms its own distinct market, shaped by factors such as the supply-demand balance. Accordingly, fluctuations in raw material prices could lead to changes in the procurement costs of products handled by the Group. In such cases, the Group’s business results and financial condition could be adversely affected. |

| Risk response measures | The Group strives to avoid this risk by passing fluctuations in raw material prices on to selling prices in a timely and appropriate manner. |

| 4. Inventory-related risks | |

|---|---|

| Description of risk | The Group handles products such as fiber raw materials, textiles and industrial textile materials, apparel products, chemicals, and transportation equipment. If market conditions deteriorate, resulting in a decline in selling prices or a prolonged inventory turnover period, and the Group is forced to record an impairment loss, its business results and financial condition could be adversely affected. |

| Risk response measures | The Group strives to optimize inventory levels by making purchases based on demand forecasts derived from factors such as past trends and orders from business partners, and by securing purchase guarantees from customers. |

| 5. Risks related to impairment of securities held | |

|---|---|

| Description of risk | The Group holds and invests in the shares of companies as it deems necessary for business purposes (carrying amount as of the end of March 2025: ¥10.4 billion). For this reason, a decline in the fair market value of listed shares in the stock market or a deterioration in the financial condition of issuers of unlisted shares, etc. may force the Group to record an impairment loss on these securities. Such impairment losses could adversely affect the Group’s business results and financial condition. |

| Risk response measures | The Group periodically reviews, at meetings of the Board of Directors, the purpose and benefits of holding or investing in the shares of companies deemed necessary for business purposes and determines whether to continue holding them. As a result, shares deemed to lack holding purpose are considered for sale, with efforts made to reduce such holdings. |

| 6. Risks related to securing human resources | |

|---|---|

| Description of risk | The Group, as a specialized trading company that handles specialized products globally, regards people as its most valuable management resource. To secure and nurture exceptionally talented individuals who are indispensable to the growth of its business, the Group has established a human resources policy and strives to attract and retain human resources. However, if securing such talented human resources becomes difficult amid trends such as a tightening labor market or an aging population with fewer children, the Group’s business results and financial condition could be adversely affected. In addition, although the Group is working to develop its business globally to achieve further growth, it may be unable to carry out business development as initially planned in certain regions due to difficulties in recruiting and retaining local human resources. |

| Risk response measures | The Group is working to strengthen its human capital by promoting diversity, equity, and inclusion (DE&I), including the acquisition of human resources who can excel on the global stage (new graduate and mid-career hires) and enabling women to realize their full potential. As part of our new graduate recruitment efforts, we hold online events regularly and have established a framework that allows us to respond effectively to applications from a wide range of regions. We are also actively recruiting mid-career professionals and hired approximately the same number of mid-career and new graduate employees in fiscal 2024. In addition, we conduct engagement surveys through external organizations to visualize engagement levels for each of our internal organizations and implement awareness-building and improvement measures to address identified issues. |

| 7. IT risk (information security) | |

|---|---|

| Description of risk | The Group implements thorough security measures. It has built and operated its networks and utilizes its information systems to conduct global business activities. However, if unexpected external unauthorized access, a cyberattack or other such incident results in the leakage of confidential information or a suspension of operations, the Group’s business results and financial condition could be adversely affected. |

| Risk response measures | The Group is strengthening the security of its information systems and enhancing information security measures. It provides training to officers and employees, including seminars and attack tests. Furthermore, in accordance with the Chori Group Basic Policy on Information Security, the Group is working to develop relevant internal regulations, raise awareness among officers and employees, and ensure the protection of its information systems and thorough information management. |

| 8. Risks related to business investments | |

|---|---|

| Description of risk | The Group provides credit to domestic and overseas buyers through a wide range of commercial transactions and investment and financing activities. For this reason, delays or the inability to collect receivables may occur, or the revision of investment and financing plans may become necessary, due to factors such as the deterioration of a business partner’s business performance or a significant delay in the business plans of an investee. In these cases, the Group’s business results and financial condition could be adversely affected. |

| Risk response measures | The Group has established Risk Management Rules for credit risk. Based on an evaluation and assessment of each business partner’s credit details, it sets individual credit limits and, where necessary, seeks to minimize the risk of default by obtaining collateral or guarantees and securing protection through trade credit insurance. Furthermore, with respect to investment and financing activities, the Group makes new investments only after thoroughly evaluating and reviewing factors such as relevance to existing businesses, potential synergies, investment profitability, conditions for exit, and the progress of the investee or financed business. The Group also regularly determines whether to continue such investments. |

| 9. Country risk (receivables collection) | |

|---|---|

| Description of risk | The Group has numerous overseas business sites and business partners and conducts sales activities and provides investment and financing for these business sites and business partners. Accordingly, delays or the inability to collect receivables may arise from changes in political, economic, and social conditions, as well as foreign currency regulations in each country; international trade barriers or trade disputes; revisions to free trade or multilateral agreements between countries; or changes in geopolitical conditions, such as regional conflicts. In such cases, the Group’s business results and financial condition could be adversely affected. |

| Risk response measures | Through collaboration with experts in each country, the Group monitors political and economic conditions as well as legal and regulatory developments and implements risk mitigation measures such as utilizing trade insurance and repatriating funds to Japan through dividends from overseas subsidiaries. In addition, the Company strives to avoid risk through measures such as setting country risk limits to manage the balance of receivables from specific countries and establishing appropriate trading conditions. |

| 10. Risks related to changes in the business environment (legal and tax systems) | |

|---|---|

| Description of risk | The Group conducts business not only in Japan but also overseas, with numerous business sites and business partners located abroad. For this reason, if the external business environment deteriorates due to political, economic, and social conditions in Japan and other countries; international trade barriers or trade disputes; and free trade or multilateral agreements between countries, or, if, in particular, changes in tax systems or differing interpretations with local tax authorities in various countries results in additional tax burdens, this could adversely affect the Group’s business results and financial condition. |

| Risk response measures | The Group has established rules concerning compliance systems, such as the Guidelines for Corporate Behavior, and sets compliance with laws, regulations, and social ethics as a code of conduct for its business activities. Building on this foundation, the Group collaborates with local experts in each country to gather and analyze information on political and economic conditions, as well as changes in systems, policies, and other relevant matters in each country, and takes appropriate action. In addition, the Group exercises the utmost caution to ensure that international transaction prices among Group companies are set at appropriate transaction prices in light of the applicable transfer pricing regulations and customs laws of each country. The Group strives to pay the proper amount of tax in accordance with each country’s tax system. |

| 11. Risks related to discrimination and harassment | |

|---|---|

| Description of risk | As stated in the Chori Group Human Rights Policy and Chori Group Basic Policy on Human Resources, the Group does not tolerate any form of discrimination or harassment. However, in the event of a violation, the Group could face negative consequences such as penalties, claims for damages, litigation issues, a decline in trust, reputational damage, or the outflow of human resources, which could adversely affect the Group’s business results and financial condition. |

| Risk response measures | The Group conducts compliance questionnaires, including questions on harassment, every year, and strives to understand actual conditions through measures such as operating its whistleblower systems (KIITE, KOTAETE) and regularly holding one-on-one meetings between supervisors and subordinates. The Group also strives to promote thorough employee awareness by conducting internal training seminars. |

| 12. Risks related to occupational health and safety | |

|---|---|

| Description of risk | The Group conducts its business operations in a working environment developed in accordance with laws, regulations, and other rules in Japan and overseas. However, in the event of a serious violation, the Group could face negative consequences such as penalties, claims for damages, litigation issues, a decline in trust, reputational damage, or the outflow of human resources, which could adversely affect the Group’s business results and financial condition. |

| Risk response measures | The Group seeks to prevent long working hours by improving operational efficiency through the preparation of various manuals, and by distributing workloads through adequate staffing and appropriate personnel assignments. In addition, the Group checks work hours and workloads to alleviate overwork by facilitating communication through measures such as regularly holding one-on-one meetings between supervisors and subordinates. |